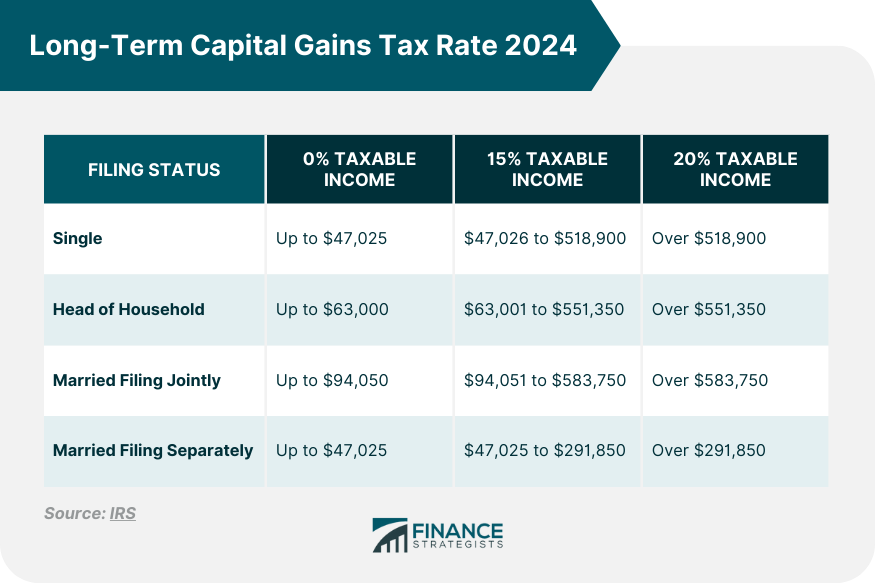

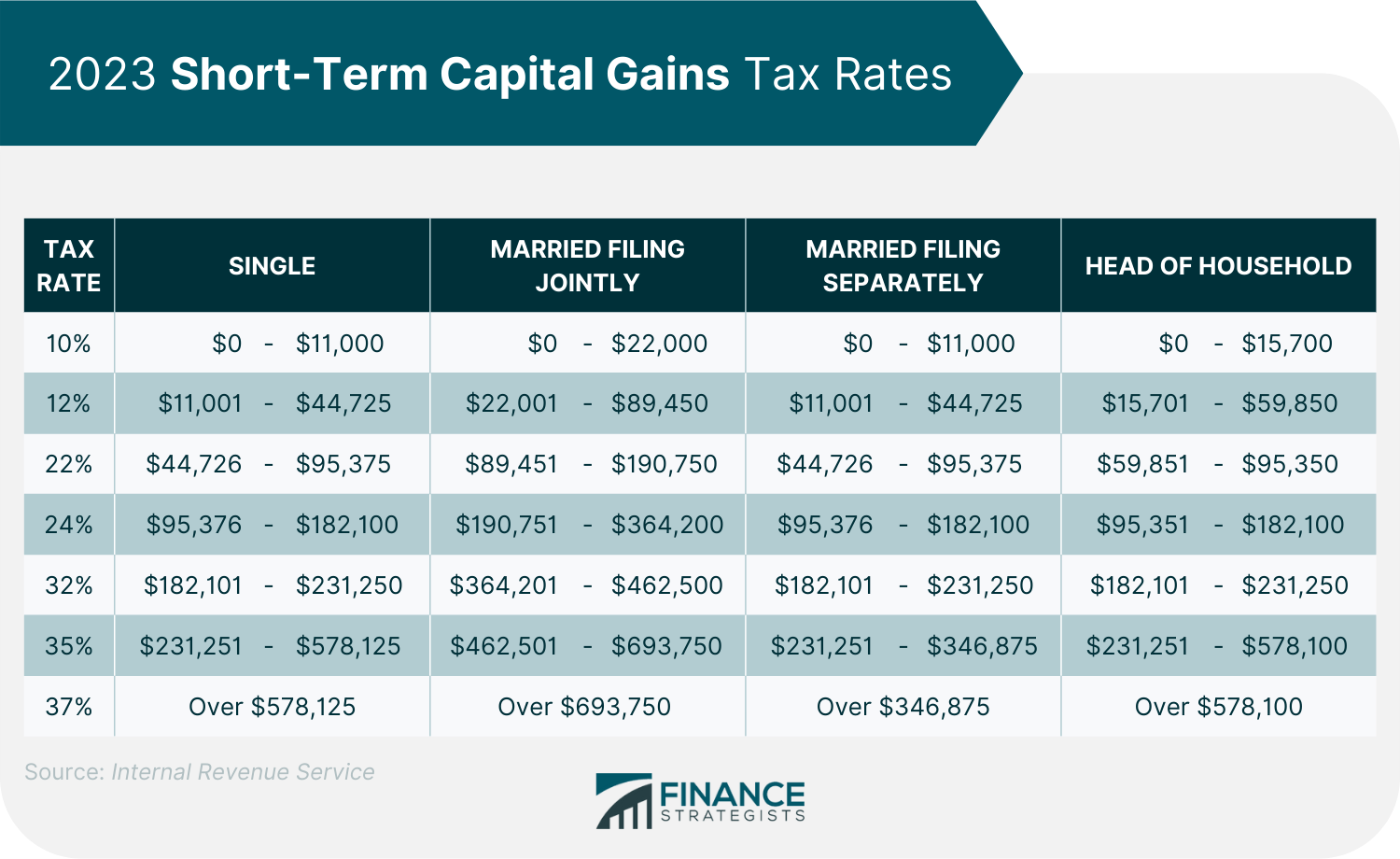

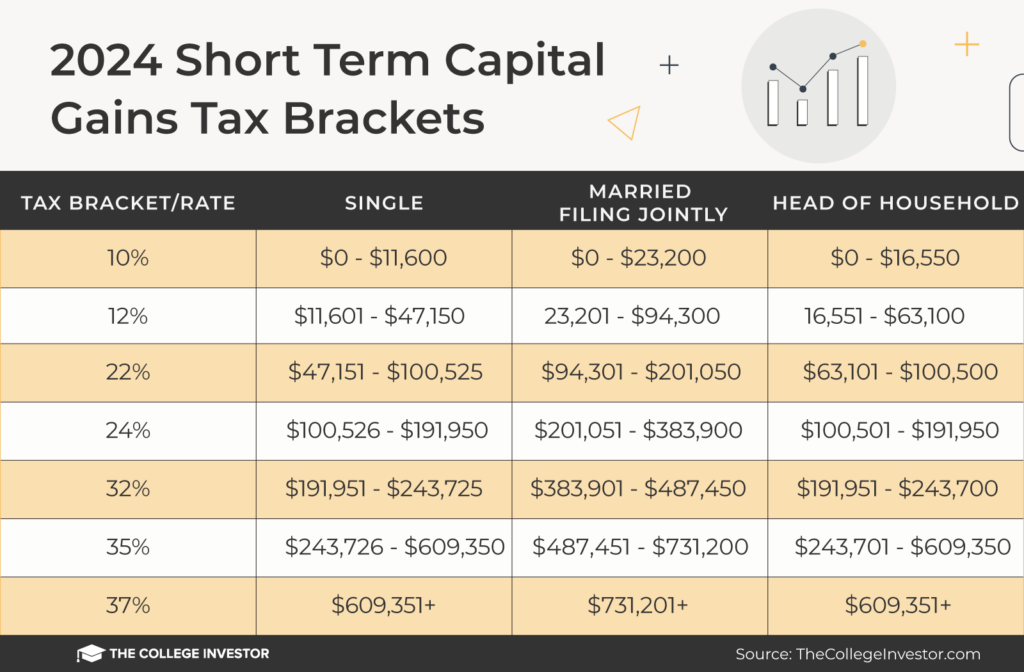

Irs Short Term Capital Gains Tax Rate 2025. When an investor sells a holding in a taxable account,. This rate ranges from 10% to 37%, depending on the filer’s federal income tax bracket and filing status.

They’re taxed like regular income. This rate ranges from 10% to 37%, depending on the filer’s federal income tax bracket and filing status.

Irs Short Term Capital Gains Tax Rate 2025 Joice Robenia, That's up from $44,625 this year.

Irs Short Term Capital Gains Tax Rate 2025 Joice Robenia, One of the best ways to reduce capital gains taxes is by holding onto investments for the long term.

Short Term Capital Gains Tax Rate 2025 Kelcy Emogene, The irs may adjust the capital gains tax rate each year.

Irs Short Term Capital Gains Tax Rate 2025 Joice Robenia, 2025 federal income tax brackets and rates.

Capital Gains Tax Rate 2025 Irs Cindy Deloria, One of the best ways to reduce capital gains taxes is by holding onto investments for the long term.

.png?width=1920&height=1024&name=Short-Term_Capital_Gains_Tax_Rates_(2023).png)

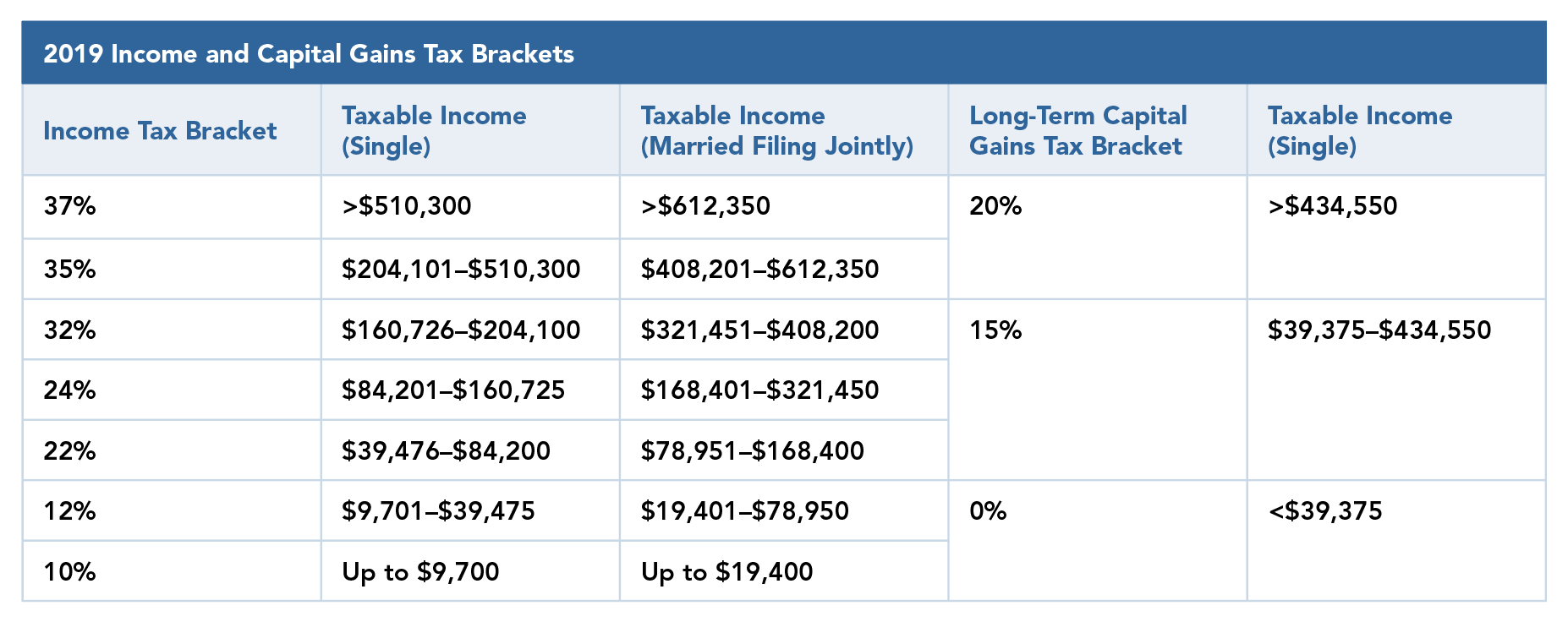

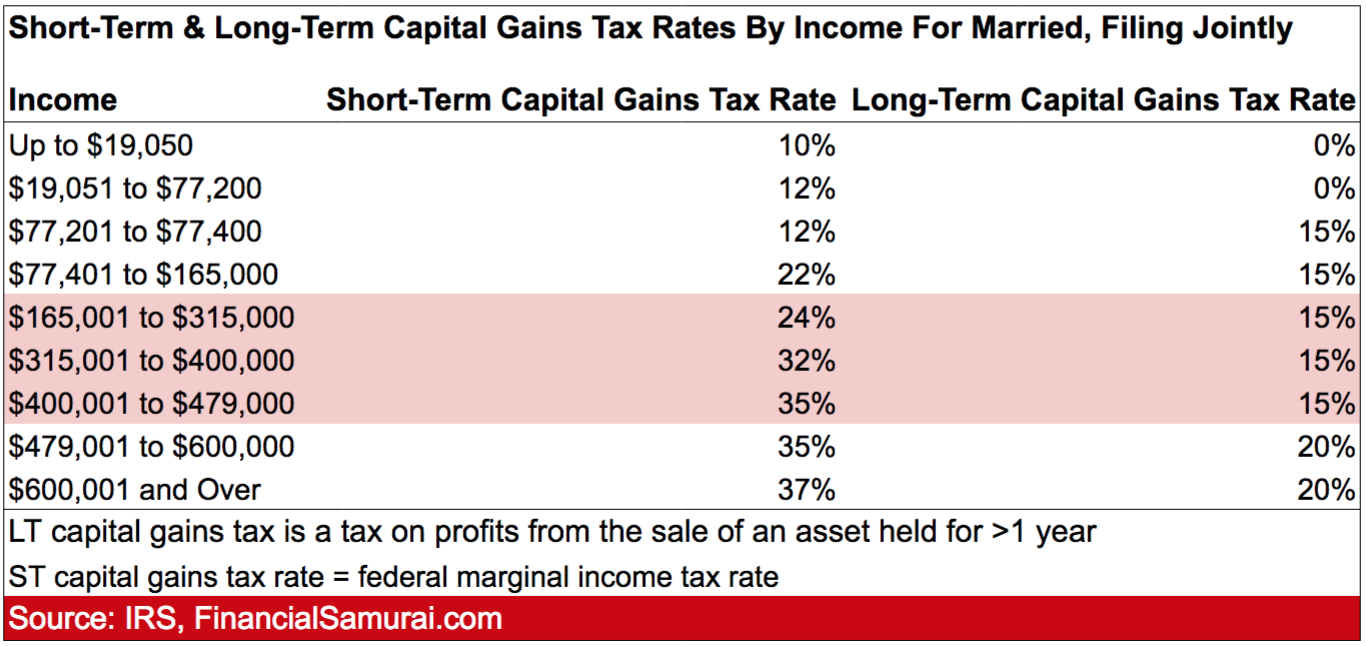

ShortTerm And LongTerm Capital Gains Tax Rates By, Short term capital gains (365 days or less) are taxed at ordinary income tax rates.

Capital Gains Tax Rate 2025 Overview and Calculation, For stocks and bonds owned for less than a year, profits.

Short Term Capital Gains Tax Rate 2025 Gayla Emelina, Here's a breakdown of how capital gains are taxed for 2025.